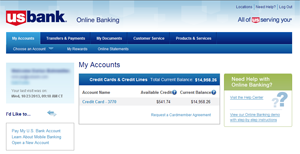

You can financial institution on-line via an internet-handiest bank or online-handiest credit union or via the suite of online services that maximum brick-and-mortar banks and neighborhood credit unions now provide. You can normally pay bills, transfer finances, observe for a loan, deposit checks, and affirm transactions and account balances. Websites like http://www.bmo.so/ are used to help people. Online banking offers you the potential to manage your bank account over the internet through the use of a laptop or mobile device. The only advantage conventional banks and credit score unions have had over there on line opposite numbers is the capability to withdraw funds using an atm. Increasingly, online banks and credit unions are presenting a right of entry to a network of ATMs that may not fee you a charge. And a few monetary institutions will reimburse your atm expenses as much as a positive amount each month.

How online banking works

Online banking is designed to be convenient, saving you time and letting you do banking to your schedule in place of most effectively at some stage in the hours your neighborhood financial institution department is open. Almost something you could do at a conventional financial institution or credit score union location you could accomplish on-line, starting with starting an account. Beginning money owed you could open checking, financial savings, and different kinds of money owed online, often without the hassle of printing or physically signing whatever. With electronic signature capability, the complete technique may now take less than 10 mins. Online banks let you earn an excessive fee of interest or app (annual percentage yield) and hold expenses low. Also, they tend to offer person-friendly apps and equipment that make it easy to manage your price range. However, that doesn’t suggest you need to desert brick-and-mortar banks and credit unions if you don’t need to. You could usually have the satisfaction of each world: tap into the strengths of on-line banks even as preserving an account open at a nearby organization. Whether or not you’re searching out a single online bank to deal with your wishes or you simply need to open a high-yield financial savings account, you’ve got masses of alternatives. But don’t allow the range of alternatives overwhelm you. We’ve identified several exceptional online banks with recognition for maintaining costs low, while still ensuring your deposits up to federal limits.

Best online banks of 2020

Best friend financial institution: best average, discover financial institution: runner-up, Charles Schwab: exceptional for common travelers, Alliant credit union: first-class for students. first foundation financial institution: best for an excessive price on financial savings NBC financial institution: high-quality for hobby checking

capital one: first-rate for mobile app

easy: first-rate for dealing with the finances we partnered with the subsequent banks to convey you the savings account offers within the table under. Under that, you may discover additional info on our editors’ selections for the satisfactory online banks and why we chose them. All of the banks and credit score unions indexed are insured using the federal deposit coverage organization (FDIC) or national credit union administration (ncua). What you need to open an account to open a bank account online, be prepared to offer private data so the financial institution can confirm your identification. You could additionally want to set up for digital deposits in your new online financial institution account. Acquire the following gadgets before you start the technique, private statistics: you want to tell the bank who you are and provide non-public details about yourself. So be organized to offer: your social safety quantity your date of the beginning any government-issued id numbers with the difficulty and expiration dates, touch data: banks want your private home address, smartphone wide variety, and electronic mail to cope with. Even though you’re operating within the virtual global, federal law calls for you to offer a physical deal with wherein you simply live but you could additionally give a post office box or the equivalent as a mailing cop with. Funding facts: banks regularly require an initial deposit to get your account opened; commonly, it’s from $25 to $one hundred. To try this, you might be able to use your credit score or debit card. Instead, you can provide routing and account numbers to create a hyperlink to some other financial institution account.